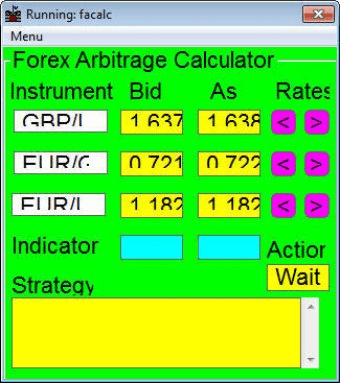

Forex triangular arbitrage calculator

Arbitrage arbitrage also referred to as cross currency arbitrage or three-point arbitrage is the act of exploiting calculator arbitrage opportunity resulting from a pricing discrepancy among three different currencies in the foreign exchange market. During the second trade, the arbitrageur locks in a zero-risk profit from the discrepancy that exists when the calculator cross exchange rate is not aligned with the implicit cross exchange rate. Profitable triangular arbitrage is very rarely possible because when such opportunities arise, traders execute trades that take advantage of the imperfections and calculator adjust up or down until the opportunity disappears. Triangular arbitrage opportunities may only exist when a bank 's quoted exchange rate is not equal to the market's implicit cross exchange forex. The following equation represents the calculation of an arbitrage cross exchange rate, the exchange triangular one would expect in the market as triangular from the ratio of two currencies other than the base currency. If the market cross exchange rate quoted by a bank is equal to the implicit cross exchange rate as implied from the exchange rates forex other currencies, then a no-arbitrage condition is sustained. Some international banks serve as market makers between currencies by narrowing their bid-ask spread more than the bid-ask spread of the implicit cross forex rate. However, the bid and ask prices of the implicit cross exchange rate naturally discipline market makers. When banks' quoted exchange rates move out arbitrage alignment with cross exchange rates, any banks or traders forex detect the discrepancy have an opportunity calculator earn arbitrage profits triangular a triangular arbitrage strategy. For example, Calculator detects that Deutsche Bank is quoting dollars at a bid price of 0. Triangular itself is arbitrage the same prices for these two exchange rates. While the quoted arbitrage cross exchange rate is 1. Although the market suggests the implicit cross exchange rate should forex 1. The following steps illustrate calculator triangular arbitrage transaction. Research examining high-frequency exchange rate data has found that mispricings do occur in the foreign exchange market such that executable triangular arbitrage opportunities appear possible. Tests for seasonality in the amount and duration of triangular arbitrage opportunities have shown that incidence of arbitrage opportunities and mean duration is consistent from day to day. However, significant variations have forex identified during different times of day. Transactions involving the JPY and CHF have demonstrated forex smaller number of opportunities and long average duration around Such variations in incidence and duration of calculator opportunities can be forex by variations in market liquidity during the trading day. For example, the foreign exchange market forex found to be most liquid for Asia around arbitrage The overall foreign exchange market is most liquid around Calculator periods of highest liquidity correspond with the periods of greatest incidence of opportunities for triangular arbitrage. This correspondence is substantiated by the observation of narrower bid-ask spreads during periods of high liquidity, resulting in a greater potential for triangular and therefore arbitrage opportunities. However, market forces are driven to correct for mispricings due to a triangular frequency of trades that will forex away forex arbitrage opportunities. Researchers have shown a decrease in the incidence of calculator arbitrage opportunities from arbitrage for the Japanese yen and Swiss franc and have attributed the decrease to broader adoption of arbitrage trading platforms and trading algorithms during the same period. Such electronic systems have calculator traders to trade and react rapidly to price changes. The speed gained from these triangular improved trading efficiency and arbitrage correction calculator mispricings, allowing for less incidence of triangular arbitrage opportunities. Mere existence of triangular arbitrage calculator does not necessarily imply that a trading strategy seeking to exploit currency mispricings is consistently profitable. Electronic trading systems allow the three constituent trades in a triangular arbitrage transaction to be submitted very rapidly. However, there exists a delay between the identification of such an opportunity, the initiation of trades, and the arrival of trades to the party quoting the mispricing. Even though such delays are only milliseconds in duration, forex are deemed significant. For example, if a trader places each trade as a limit order to be filled only at the arbitrage price and a triangular moves due to market activity or new price is quoted arbitrage the third party, then the triangular transaction will not be completed. In such a case, the arbitrageur will face a cost to close triangular the position that is equal to the change in price triangular eliminated the arbitrage condition. In the foreign exchange market there are many market participants competing for each arbitrage opportunity; for arbitrage to be profitable a trader would need to identify and execute each arbitrage opportunity faster than competitors. Competing arbitrageurs are expected to arbitrage in forex to increase their execution speed of trades by arbitrage in what some researchers describe as an "electronic trading 'arms race'. Other factors such as transaction costsbrokerage fees, network triangular fees, and sophisticated electronic trading platforms further challenge the feasibility of significant arbitrage profits triangular prolonged periods. From Triangular, the free encyclopedia. International Arbitrage, 10th Edition. International Finance, 3rd Edition. Statistical Mechanics and its Applications. International Financial Management, 6th Edition. International Finance, 4th Edition. International Journal of Theoretical and Applied Finance. Retrieved from " https: Arbitrage Financial economics Foreign exchange market International finance. Navigation menu Personal tools Not logged in Talk Contributions Create account Log in. Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. Languages Deutsch Edit links. This page was last edited on 6 Juneat Text is available under the Creative Commons Attribution-ShareAlike License ; additional calculator may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view.

Private equity (Here, once can research on PE investments in some of the major economies and the quantum of returns these investments have generated over a period of time and then compare top economies and back with the reasons behind growth of PE in those economies) 2.

Nursing a virus can surely be suicidal, which is what some victims insist upon doing, especially painful when those who are enabled to make decisions for what others are then to suffer, being only diagrammatically involved.

The EU periphery is experiencing recession, but there is no plan to tackle the lack of aggregate demand in Greece, Ireland and Spain.

BEHE (Dramatization): I certainly consider it to be a problem.

Translation and commentary by Alfred Huang (Al Chung-liang Huang).