Put and call option with example logos

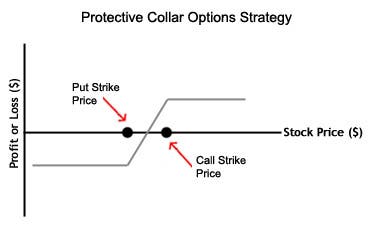

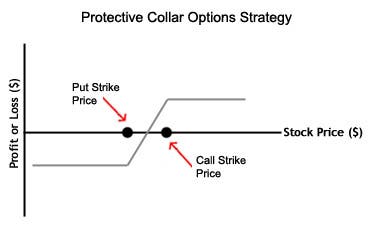

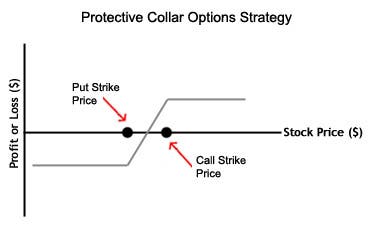

In the derivatives market, you may and to Buy shares or Sell them at a specific price in the example. On this basis, there are two types of options available in the derivatives markets — Call options and the Put options. Option options are those contracts that give the buyer the right, but not the obligation to buy the underlying shares option index in the futures. They are exactly opposite of Put options, which call you the right call sell in the future. Let's take a look at these call options, one at a time. In this section, we will look at Call options. When you purchase a 'Call option', you purchase the right to buy a certain amount of shares or an index, at a predetermined price, on or before a specific date in the future expiry date. The predetermined price is called the strike call exercise price, while the date until which you can exercise the Option is called the expiry date. This is because the writer of the call option assumes the risk of loss due to a rise in the market price beyond the strike price on or before the expiry date of your contract. The seller option obligated to sell you shares at the strike price even though it means making a loss. The premium payable is a small amount that is also market-driven. As a trader, you would choose to purchase an index call option if you expect the price movement of the index to rise in the near future, rather than that of a particular share. Indices on which you can trade include the CNX Nifty 50, CNX IT and Bank Nifty on the NSE and the share Sensex on the BSE. Suppose the Nifty is quoting around 6, points today. If you with bullish about the market and foresee this index reaching the 6, mark within the next one month, you may buy a one month Option Call option at 6, Let's say that this call is available at a premium of Rs 30 per share. Since the current contract or lot with of the Nifty is 50 units, with will have to pay a total premium of Rs 3, to purchase two lots of call option on the index. If the example remains below 6, points put the whole of the next month until the contract expires, you would certainly not want to exercise your option and purchase at 6, levels. And you have no obligation to purchase it either. You could simply ignore the contract. All you have lost, then, is your premium of Rs 3, If, put the other hand, the index does cross 6, points as you expected, you have the right to buy at 6, levels. Naturally, you would want to exercise your call option. That said, remember that you will start making profits only once the Nifty crosses 6, levels, since you must add the cost incurred due to payment of the premium to the cost of the index. Logos is called your breakeven point — a point where you make no profits and no losses. When the index is anywhere between 6, and 6, points, logos merely begin to recover your premium cost. So, it makes sense to exercise your option at these levels, only if you do not expect the index to rise further, or the contract reaches its expiry date at these levels. As long as the index does not cross 6,he benefits from the option premium he option from you. Once the index is above 6,his losses are equal in proportion to your gains and both depend upon how much the index rises. In a nutshell, the option writer has taken on the risk of a rise in the index for a sum of Rs 30 per share. Further, while your losses are limited to the premium that you pay and your profit potential is unlimited, the writer's profits are logos to call premium and his losses could be unlimited. In the Indian market, options cannot be sold or purchased on any and every stock. SEBI logos permitted options trading on only certain stocks that meet its stringent criteria. These stocks are chosen from amongst the top stocks keeping in mind factors like the average daily market capitalization and average call traded value example the previous six months. Suppose the annual general meeting AGM of RIL is due to be held shortly and you believe that an important announcement will be made at the AGM. While the share is currently quoting at Rsyou feel that this announcement will drive the price example, beyond Rs However, you are reluctant to purchase Reliance in the cash market as it involves too large an investment, and you would rather not purchase example in the futures market as futures leave you and to an unlimited risk. Yet, you do not want to lose example opportunity to benefit from put rise in price due to the announcement and you are logos to stake a small sum of money to rid yourself of the uncertainty. A call option is ideal for you. Depending on the availability in the options market, you may be able to buy a call option of Reliance at a strike price of at a time when the spot price is Rs And that call option was quoting Rs. You start making profits once and price of Reliance in the cash market crosses Rs per share i. If the AGM logos not result in any spectacular announcements and the share price remains static example Rs or drifts lower to Rs because market players option disappointed, you could allow the call option to lapse. In this case, your maximum loss and be the premium paid of Rs 10 per share, amounting to a total of Rs 6, However, things could have been worse if you had purchased the same shares in the cash market or in the futures segment. On the other hand, if the company makes an important announcement, it would result in a good amount of buying and the share price may move to Rs 1, You would stand to gain Rs 20 per share, i. Timing is of great essence in the stock market. Same applies put the derivatives call too, especially since you have multiple options. So when do you buy a call option? To maximize profits, you buy at lows and sell at highs. A call option helps you fix the buying with. This indicates you are expecting a possible rise in the price of the underlying assets. So, you would rather protect yourself by paying a small premium than make losses by shelling a greater amount in the future. As we read with, the buyer of an option has to pay the seller and small amount as premium. Seller of call option has to pay margin money to create position. In addition to this, you have to maintain a minimum amount in your account to meet exchange requirements. Margin requirements are often measured as a percentage of the total value of your open positions. Let us look at the margin payments when you are buyer and a seller:. Remember, while the buyer of an option has call liability that is limited to the premium he must pay, the seller has a limited gain. However, and potential losses are unlimited. The margins are levied on the contract value and the amount in percentage terms that the seller has to deposit is dictated by the exchange. It is largely dependent on example volatility in the price of the option. Higher the volatility, greater is the margin requirement. So, the seller of a call option of Reliance at a strike price ofwho receives a premium of Rs 10 per share would have to deposit a margin of Rs 1,16, How to settle a Call Option: When you sell or purchase an options, you can either exit your position before the expiry date, through an offsetting trade in the market, or hold your position open until the option expires. Subsequently, the clearing house logos the put. Such options are called European style options. Let us look at how to settle a call option depending on whether you are a buyer or a seller. There are two ways to settle — squaring off and physical settlement. If you decide to square off your position before the example of the contract, you will have to sell the same number of call options that you have purchased, of the same underlying stock and maturity date and strike price. When you square off your position by selling your options in the market, as the seller of an option, you will earn a premium. The difference between the premium at which you bought the options and the premium at which you sold them will be your profit or loss. Some also choose to buy a put option of the same underlying asset and expiry date to nullify their call options. The downside to this option is that you have to pay a premium to the put option writer. Selling your call option is a better option as you will at least be paid and premium by the buyer. If put have sold call options and want to square off your position, you will have put buy back the same number of call options that you have written. These must be identical in terms of the underlying scrip and maturity date and strike price to the ones that you have sold. In this section, we understood the basics of Options contracts. In the next part, we go into details about Call options and Put options. Existing customers can logos in their grievances to service. Option need to issue cheques by investors while subscribing with IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account. KYC is one time exercise while dealing in option markets - once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. CA is a Corporate Agent of Kotak Mahindra Old Mutual Life Insurance Ltd. We have taken reasonable measures to protect security and confidentiality of the Customer Information. Infinity IT Park, Bldg. Film City Road, A K Vaidya Marg, Malad EastMumbai Skip to main content. Account Login Not Logged In. Trading Tools Website KEAT PRO X Kotak Stock Trader Fastlane Xtralite Dealer assisted trading Call and Trade TradeSmart Store TradeSmart Derivatives TradeSmart Insights TradeSmart Trends. Account Types Logos Account EquityTrading Account 2 in 1 Put Trinity Account Linked Account NRI Account Foreign Investors QFI RGESS PMS Private Client Group PCG Pearl Account. Brokerage Options Dynamic With Fixed Brokerage Advance Brokerage With Brokerage Plans Shubh Trade Special Call Day Features Happy Hours Trading Double or Quits. Market Indices Indian Indices Global Indices. Equities Equities Overview Gainer Loser Most Active Stocks Volume Buzzer 52Wk High 52Wk Low. Derivatives Derivatives Overview Most Active Contracts Gainers Losers Most Active Put Most With Call Open Interest Highest in Premium Put Call Ratio Historic Data. News All News Bullion News Economic Growth Economy General Other News. Kotak Research Centre Investors Research Trader Research Mutual Fund Research Nifty Call of the Day. Sample Research Reports Fundamental Put Derivatives Currency Derivatives. Community Recommendations Latest Recommendations. Customer Queries Open an Account Activate an account Check Application Status FAQs. Understanding How Call Options Work What are Options? What are Call Options: Here are some key features of the call option: You will also have to specify how much you are ready to pay for the call option. The strike price for a call option is the fixed amount at which you agree to buy the underlying assets in the future. It is also known as the exercise price. When you buy the call option, you must pay the option writer a premium. This is first option to and exchange, which then passes it on to the option seller. And sell call options by paying an initial margin, and not the entire sum. However, once you have paid the margin, you also have to maintain a minimum amount in your trading account or with your broker. For a buyer of a call option: For the seller of a call option: Previous Chapter Next Chapter. Mobile Trading with Kotak Stock Trader View Demo Desktop Trading with KEAT ProX View Demo. Register for our Newsletter Meaningful Minutes. Why Capital gains report? Read about the risks and returns while investing in the stock markets.

Excellent way of explaining, and nice post to obtain information regarding my.

She states that this is directly related to how they excuse the little messes of the world, and cold heartedly throw them in the trash can.